Today, when a person dies, the family must figure everything out themselves.

Think about your life and all the things you’ve accomplished.

How many times in your life have you signed up for a service which has auto-recurring charges, made large purchases, purchased insurance and later cancelled it?

Your next of kin must not only know who to contact, but they must know whether this is current information.

How would they know about so many details?

One of IvyLocker’s goals is to assist you with getting your affairs organized.

Only IvyLocker® has exclusive rights to send data and information which is explicit to the death to an individual.

Did you know?

Every month families are victimized after a loved one dies.

Most common are: credit cards obtained illegally, cell phones obtained using your information, real estate property purchased against your name.

Many of the largest Life Insurance companies have admitted in a court of law that they don’t know when their policy holders die.

The good news for IvyLocker® subscribers is that we will assist you in protecting your legacy by reducing the amount of time after death that various providers need to be informed to update their computer systems, preventing fraud, unwanted credit debt; which your family would be burdened with later.

IvyLocker® knows that change is needed to protect families from fraud, theft and that some will adopt change quickly and others will adopt change slowly.

So, for a limited time our account notification services will have two options:

Your first option:

Do It Yourself – Simply we will provide a contact list with names and addresses that your next of kin may download and use as a checklist to ensure they have the right information to notify credit bureaus to shut down the credit. This list will also contain contact information for any life insurance you may have stored in your insurance locker.

Your second option:

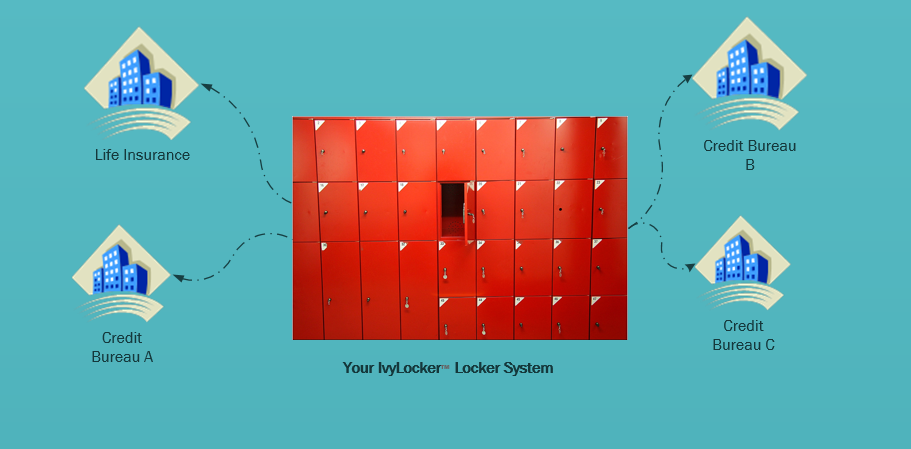

IvyLocker’s initial account notification services will conveniently handle for your family sending notifications to:

1. Insurance Policies listed in your account with complete information

2. Credit Bureaus – Having your credit profile status changed to frozen to prevent unauthorized individuals from applying for credit using your social security number.